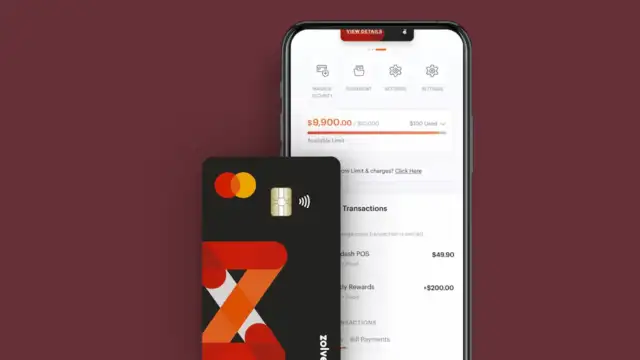

Discover the Zolve Credit Card, a high-limit, no-SSN-required solution designed to simplify your financial journey in the U.S.

What you need to know about this credit card:

- High credit limit: Access up to $10,000 for purchases and emergencies.

- No SSN required: Get started with just your visa, passport, and basic personal details.

- No foreign transaction fees: Enjoy global spending without extra costs.

- Build your credit score: Payments are reported to U.S. credit bureaus to help establish your FICO score.

Pros

- Generous cashback: Earn 5% on your favorite brands and 1% unlimited cashback on all purchases.

- International usability: Shop worldwide with no additional transaction fees.

- Easy application: Apply online in just 5 minutes, even before arriving in the U.S.

- Secure management: Freeze or unfreeze your card instantly via the app.

- Reward programs: Enjoy exclusive offers and rewards at partner stores.

Cons

- Limited availability: Primarily designed for newcomers to the U.S.

- Partner network restrictions: Cashback benefits apply to selected brands.

Why Choose Zolve for your credit card?

Compared to Chase Bank, Zolve provides instant approval without requiring an established U.S. credit history.

Unlike Capital One, Zolve doesn’t demand a security deposit for its high-limit credit card.

While Bank of America often requires an SSN, Zolve only needs basic identification documents.

Wells Fargo cards might charge foreign transaction fees, but Zolve eliminates these for international users.

Compared to Tomo, Zolve offers a higher credit limit, providing more financial flexibility for big purchases.

Zolve Credit Card: let’s get to know it a little better

How to apply for your Zolve Credit Card

Unlock endless opportunities with the Zolve Credit Card! Click the button below to explore everything it offers and start your application.