Named One of Newsweek’s 2023 Most Trustworthy Companies in America, Green Dot Bank is trusted by millions of Americans for its innovative financial solutions.

What you need to know about this credit card:

- Cashback rate: Up to 3% on qualifying online and in-app purchases.

- High-yield savings: 3% annual interest on balances up to $10,000.

- Monthly fee: $7.95, waived with $1,000 in monthly spending.

- No overdraft fees: Spend confidently without hidden charges.

Pros:

- Earn 3% cashback on qualifying purchases, perfect for online shoppers.

- Enjoy a 3% APY savings account, maximizing your earnings.

- Avoid overdraft stress with no overdraft fees.

- Access free ATM withdrawals within the Green Dot network.

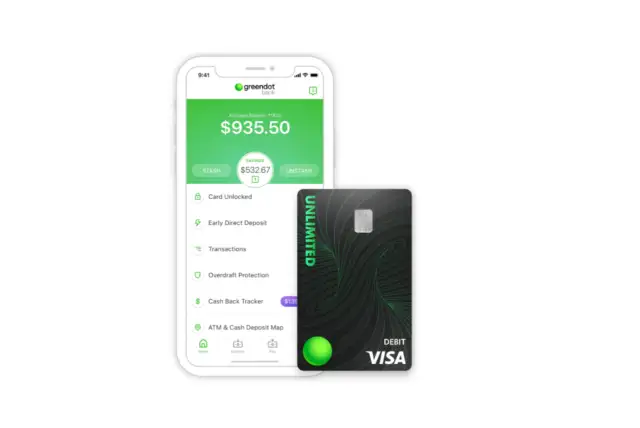

- Manage your account seamlessly via the user-friendly mobile app.

Cons:

- Monthly fee applies if spending criteria aren’t met.

- Limited cashback eligibility for in-store purchases.

Why Choose Green Dot® for Your Credit Card?

Compared to the Blue Cash Everyday® Card by American Express, Green Dot® Unlimited stands out with higher cashback rates for online purchases.

While the Discover it® Cash Back offers rotating categories, Green Dot® provides consistent rewards.

Chase Freedom Unlimited® gives 1.5% on all purchases, but Green Dot®’s 3% cashback is unmatched for online shoppers.

Citi® Double Cash and Capital One® Quicksilver® provide straightforward rewards but lack Green Dot®’s savings benefits and fee waivers.

If online shopping is your forte, Green Dot® Unlimited is a no-brainer.

Green Dot® Unlimited: let’s get to know it a little better

How to Apply for Your Green Dot® Unlimited

Ready to maximize your cashback and savings? Click below to apply and start your journey with Green Dot® Unlimited today!