American Express has over 100 million cards in force globally and is known for its excellent customer service.

What you need to know about this credit card:

- Annual Fee: $695

- APR: 21.24% to 29.24% Variable

- Welcome Offer: 125,000 Membership Rewards® Points after $8,000 spent in first 6 months

- Credit Score Required: Good to Excellent

Pros

- $200 Hotel Credit: Annual statement credits for hotel bookings.

- $240 Digital Entertainment Credit: Monthly credits for popular streaming services.

- $200 Airline Fee Credit: Annual statement credits for incidental airline fees.

- Access to 1,400+ Airport Lounges: Extensive lounge access worldwide.

- $200 Uber Cash: Monthly Uber credits for rides or Uber Eats.

Cons

- High Annual Fee: $695, which may not suit every budget.

- APR Range: Variable APR of 21.24% to 29.24%.

Why Choose American Express for your credit card?

American Express stands out with its exclusive benefits and top-tier rewards.

Compared to Chase Credit Cards, Amex offers more lounge access.

While Bank of America provides competitive rates, Amex excels in luxury perks.

Capital One may have lower fees, but Amex Platinum’s rewards are unmatched.

Discover cards are great for cashback, yet Amex Platinum’s travel perks are superior. Amex also surpasses many in customer service and global reach.

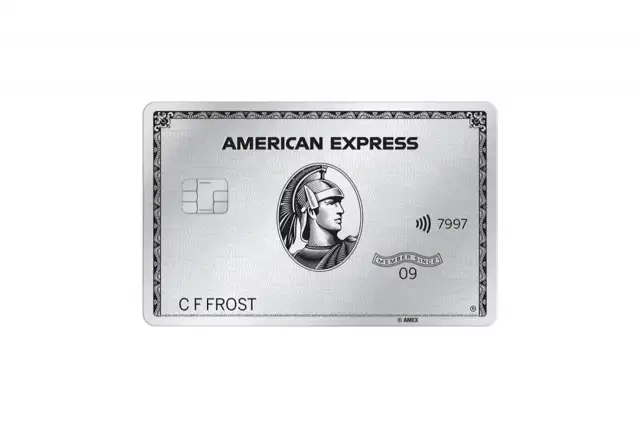

American Express Platinum Card: let’s get to know it a little better

How to apply for your American Express Platinum Card

Explore the benefits and apply by clicking the button below to learn more about this prestigious card.