The Bank of Missouri, established in 1891, is a long-standing financial institution with over $2.9 billion in assets. Continental Finance has helped millions of users rebuild credit since 2005.

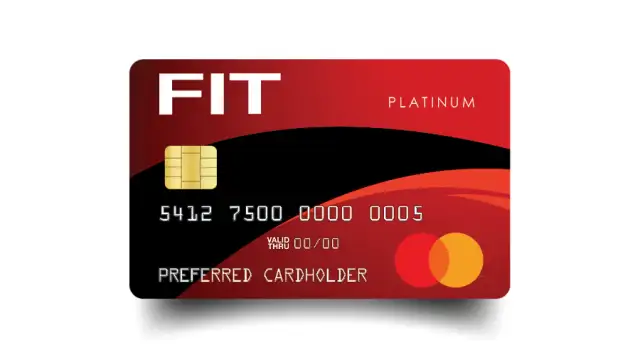

What you need to know about this credit card:

- Starting Limit: $400 credit line available immediately upon approval.

- Credit Rebuilding: Monthly reporting to TransUnion, Experian, and Equifax.

- Real-Time Monitoring: Free monthly score through e-statements.

- Global Access: Accepted worldwide with Mastercard.

Pros:

- Helps Rebuild Credit – Designed for users looking to boost their score.

- Trusted Issuer – Backed by The Bank of Missouri’s 130+ year legacy.

- Secure – Mastercard’s fraud protection offers peace of mind.

- Access Anywhere – Shop, dine, and travel anywhere Mastercard is accepted.

- Easy Online Management – Mobile and desktop access to your account.

Cons:

- No Cashback or Points – This card’s focus is credit improvement.

- Potential Monthly Fees – Read the fine print for recurring charges.

Why Choose The Bank of Missouri for Your Credit Card?

FIT Mastercard beats First Progress Platinum by offering free credit scores.

Compared to Indigo® Mastercard, FIT has fewer setup fees.

AvantCard requires higher income thresholds—FIT is more inclusive.

Unlike Chime, there’s no need to open a separate bank account.

Reflex® Mastercard has a similar profile but lacks the same mobile app quality.

FIT Mastercard®: Let’s Get to Know It a Little Better

How to Apply for Your FIT Mastercard®

Click the button and apply in minutes. No perfect score needed. You could get approved for a $400 limit and start tracking your credit improvement immediately!