Bank Mandiri, Indonesia’s largest bank by assets, serves over 20 million customers nationwide.

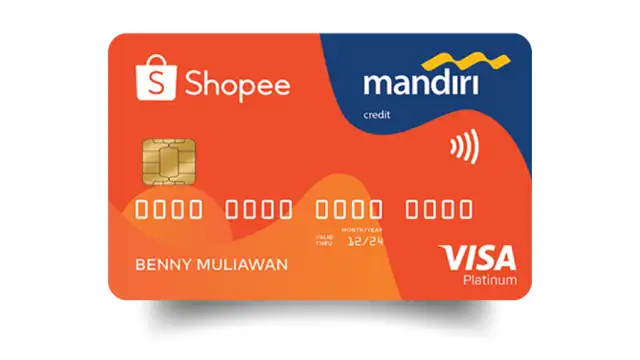

What you need to know about this credit card:

-

Minimum Income Requirement: Rp3,000,000 per month.

-

Credit Limit Range: Rp2,000,000 to Rp500,000,000.

-

Annual Fee: Rp300,000 (waived for the first year).

-

Interest Rate: 1.75% per month on retail transactions.

Pros:

-

Generous Welcome Bonus: Receive up to 250,000 Shopee Coins upon approval and first transaction.

-

Enhanced Rewards: Earn 5x Shopee Coins on food and beverage purchases.

-

Daily Cashback: Up to 100,000 Shopee Coins cashback on daily Shopee transactions.

-

Purchase Protection: Insurance coverage up to Rp25,000,000 for your purchases.

-

Contactless Payments: Enjoy the convenience of tap-and-go transactions.

Cons:

-

Annual Fee Applies After First Year: Rp300,000 from the second year onwards.

-

Mandatory Form Submission: Failure to complete the required form may result in forfeiting Shopee Coin benefits.

Why choose Bank Mandiri for your credit card?

Compared to BCA’s Everyday Card, Mandiri Shopee offers higher cashback rates on daily purchases.

Unlike BRI’s Touch Card, which lacks e-commerce integration, Mandiri Shopee seamlessly connects with Shopee for instant rewards.

BTN’s Classic Card doesn’t provide the same level of purchase protection that Mandiri Shopee ensures.

BNI’s Silver Card offers lower reward points per transaction compared to Mandiri Shopee’s generous coin system.

CIMB’s Classic Card lacks the contactless payment feature that Mandiri Shopee provides for faster checkouts.

Mandiri Shopee credit card: let’s get to Know It a Little Better

How to apply for your Mandiri Shopee credit card

Applying is simple! Click the I WANT THIS CARD button below, fill out the application form, and start enjoying the multitude of benefits that come with the Mandiri Shopee Credit Card.